3 Step Check Up

Are you on track for a financially secure retirement with choices? Use our 3 Step Check Up to find out today.

Step 1: Where are you in your life?

Where are you on your retirement planning journey? We have prepared a series of guides to help you assess what you need to be thinking about and any steps you need to consider in relation to retirement planning.

QUICK TIP: START SMALL, START EARLY.

While it might be too early to have a structured retirement plan in place at this stage of your life, there are two very good reasons to be savvy with your retirement savings and KiwiSaver: (1) in the not-too-distant future you may want to tap into your KiwiSaver funds for your first home deposit, and (2) the earlier you start saving, the longer your funds will have to grow. Remember, thanks to compounding returns, as the return on your investment grows, your funds will pick up speed.

Hidden member only content, please login to access.

QUICK TIP: TIME TO REASSESS YOUR CONTRIBUTION RATE.

Your early 30s to mid-40's - it's a busy time of life typically with many competing financial priorities - you may be starting a family, a business, paying down debt (mortgage etc), building a career...

But while planning for retirement might be some way down that list of priorities, at this stage of life - if affordable - it can make good sense to bump up your retirement savings. Remember, the more time your funds will have to grow, the more you can benefit from compounding returns.

Hidden member only content, please login to access.

QUICK TIP: BROADEN YOUR RETIREMENT SAVINGS TOOLBOX.

During this stage of life (late 40s to mid 50s), often there are fewer financial commitments to worry about and debt is being nicely paid down. So, it's time to have a good think about how to maximise your financial position in preparation for life after work.

As well as reviewing your KiwiSaver settings, are there other investment tools (property, shares etc) that suit your risk profile and needs? What will strengthen your retirement savings toolbox?

Hidden member only content, please login to access

QUICK TIP: TAKE STOCK AND TAKE ACTION.

As the 'biggest holiday of a lifetime' draws near, it's time to take stock, and if needs be, act. The last five to ten years before retirement can be crucially important to your financial security and freedom in your post-work life. It's time to assess any gaps in your retirement plan, and act on them.

And as for KiwiSaver, look at your contributions, check that your fund type is appropriate to your investment horizon and risk profile, and start thinking about how and when you plan to access your funds in retirement.

Hidden member only content, please login to access.

QUICK TIP: CREATE TIME BUCKETS

Decades of hard work and now it's time to enjoy some quality R&R, your way. Perhaps one of the most important things to get right at this stage of life, financially speaking, is ensuring your that KiwiSaver and other retirement savings go the distance.

One method you might like consider is setting up a series of ‘time buckets’ (short-term bucket, medium-term bucket, and long-term bucket) and spitting your savings across them. Diversifying like this help you to protect the savings you want to use in the short term, while also giving your KiwiSaver the opportunity to grow further.

Hidden member only content, please login to access.

Step 1: Where are you in your life?

Where are you on your retirement planning journey? We have prepared a series of guides to help you assess what you need to be thinking about and any steps you need to consider in relation to retirement planning.

Starting

QUICK TIP: START SMALL, START EARLY.

While it might be too early to have a structured retirement plan in place at this stage of your life, there are two very good reasons to be savvy with your retirement savings and KiwiSaver: (1) in the not-too-distant future you may want to tap into your KiwiSaver funds for your first home deposit, and (2) the earlier you start saving, the longer your funds will have to grow. Remember, thanks to compounding returns, as the return on your investment grows, your funds will pick up speed.

Hidden member only content, please login to access.

Growing

QUICK TIP: TIME TO REASSESS YOUR CONTRIBUTION RATE.

Your early 30s to mid-40’s – it’s a busy time of life typically with many competing financial priorities – you may be starting a family, a business, paying down debt (mortgage etc), building a career…

But while planning for retirement might be some way down that list of priorities, at this stage of life – if affordable – it can make good sense to bump up your retirement savings. Remember, the more time your funds will have to grow, the more you can benefit from compounding returns.

Hidden member only content, please login to access.

Consolidating

QUICK TIP: BROADEN YOUR RETIREMENT SAVINGS TOOLBOX.

During this stage of life (late 40s to mid 50s), often there are fewer financial commitments to worry about and debt is being nicely paid down. So, it’s time to have a good think about how to maximise your financial position in preparation for life after work.

As well as reviewing your KiwiSaver settings, are there other investment tools (property, shares etc) that suit your risk profile and needs? What will strengthen your retirement savings toolbox?

Hidden member only content, please login to access

Nearing

QUICK TIP: TAKE STOCK AND TAKE ACTION.

As the ‘biggest holiday of a lifetime’ draws near, it’s time to take stock, and if needs be, act. The last five to ten years before retirement can be crucially important to your financial security and freedom in your post-work life. It’s time to assess any gaps in your retirement plan, and act on them.

And as for KiwiSaver, look at your contributions, check that your fund type is appropriate to your investment horizon and risk profile, and start thinking about how and when you plan to access your funds in retirement.

Hidden member only content, please login to access.

Retired

QUICK TIP: CREATE TIME BUCKETS

Decades of hard work and now it’s time to enjoy some quality R&R, your way. Perhaps one of the most important things to get right at this stage of life, financially speaking, is ensuring your that KiwiSaver and other retirement savings go the distance.

One method you might like consider is setting up a series of ‘time buckets’ (short-term bucket, medium-term bucket, and long-term bucket) and spitting your savings across them. Diversifying like this help you to protect the savings you want to use in the short term, while also giving your KiwiSaver the opportunity to grow further.

Hidden member only content, please login to access.

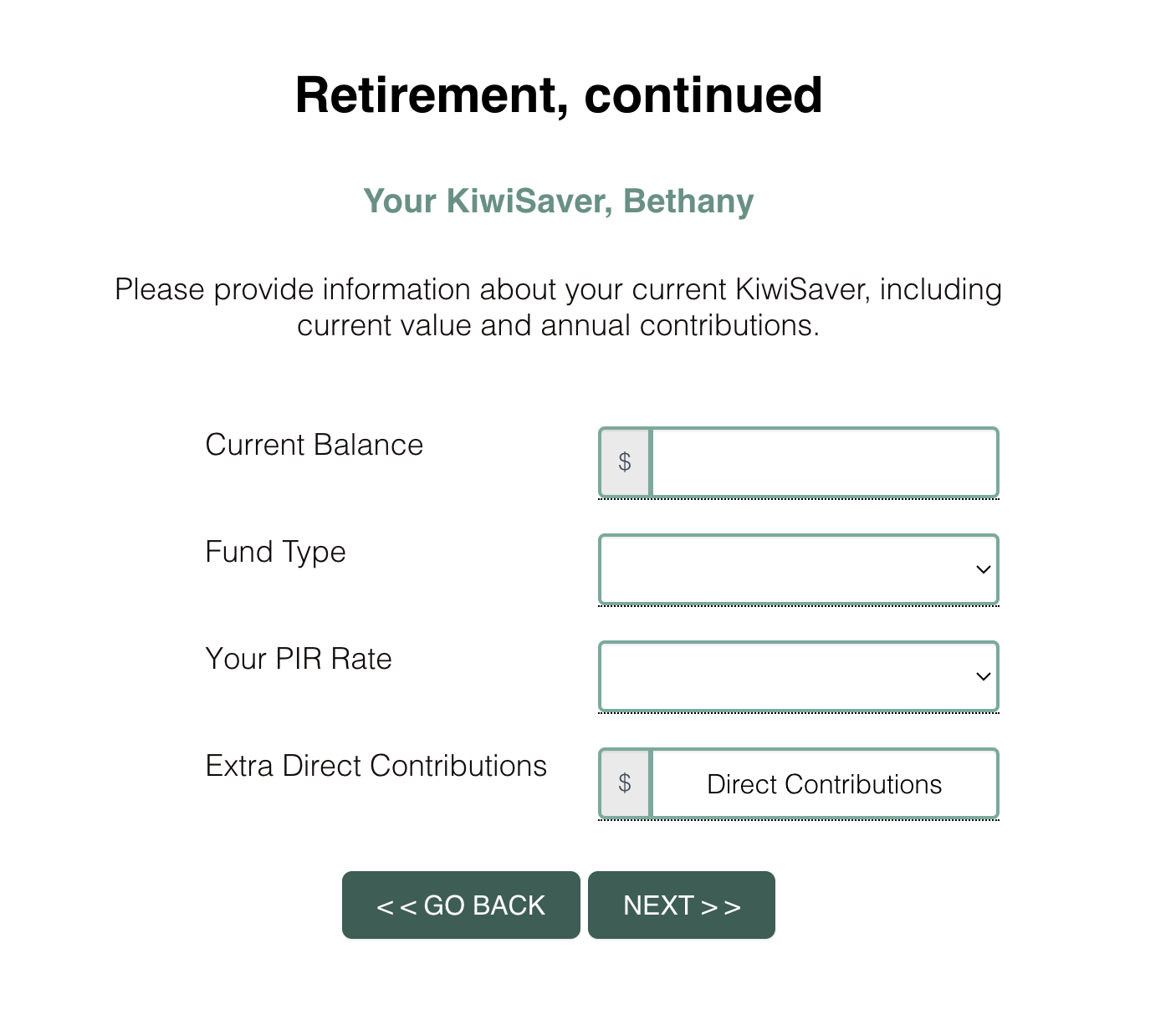

Step 3: Are you on track for retirement?

What’s your retirement savings goal? And are you on track? Use our calculator to run your numbers – a helpful tool to set or adjust your savings plan.

QUICK TIP: TIME TO REASSESS YOUR CONTRIBUTION RATE.

Your early 30s to mid-40’s – it’s a busy time of life typically with many competing financial priorities – you may be starting a family, a business, paying down debt (mortgage etc), building a career…

But while planning for retirement might be some way down that list of priorities, at this stage of life – if affordable – it can make good sense to bump up your retirement savings. Remember, the more time your funds will have to grow, the more you can benefit from compounding returns.

. Hidden member only content, please login to access

QUICK TIP: BROADEN YOUR RETIREMENT SAVINGS TOOLBOX.

During this stage of life (late 40s to mid 50s), often there are fewer financial commitments to worry about and debt is being nicely paid down. So, it’s time to have a good think about how to maximise your financial position in preparation for life after work.

As well as reviewing your KiwiSaver settings, are there other investment tools (property, shares etc) that suit your risk profile and needs? What will strengthen your retirement savings toolbox?

QUICK TIP: TAKE STOCK AND TAKE ACTION.

As the ‘biggest holiday of a lifetime’ draws near, it’s time to take stock, and if needs be, act. The last five to ten years before retirement can be crucially important to your financial security and freedom in your post-work life. It’s time to assess any gaps in your retirement plan, and act on them.

And as for KiwiSaver, look at your contributions, check that your fund type is appropriate to your investment horizon and risk profile, and start thinking about how and when you plan to access your funds in retirement.

. Hidden member only content, please login to access

QUICK TIP: CREATE TIME BUCKETS

Decades of hard work and now it’s time to enjoy some quality R&R, your way. Perhaps one of the most important things to get right at this stage of life, financially speaking, is ensuring your that KiwiSaver and other retirement savings go the distance.

One method you might like consider is setting up a series of ‘time buckets’ (short-term bucket, medium-term bucket, and long-term bucket) and spitting your savings across them. Diversifying like this help you to protect the savings you want to use in the short term, while also giving your KiwiSaver the opportunity to grow further.

. Hidden member only content, please login to access

Help is at hand

A quick KiwiSaver-question? We're here to help. Is it time to take a good look at your financial plan? We can help there too. From simple queries through to advice for retirement, investment, and financial planning, we welcome you to get in touch.

Help is at hand

A quick KiwiSaver-question? We're here to help. Is it time to take a good look at your financial plan? We can help there too. From simple queries through to advice for retirement, investment, and financial planning, we welcome you to get in touch.

MONEY MATTERS ON YOUR MIND?

Talk to an expert financial planning advisers with decades of experience. We're here to help.

LIKE TO BOOK A MEETING?

Find a time that works for you for a Teams, phone or in-person meeting.